Investment Triangle - Discipline & Time

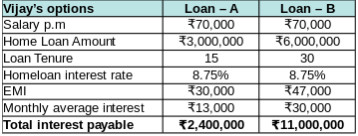

Knowledge, Discipline & Time are the 3 vertices of an investment triangle. In this issue, we are going to examine the next 2 vertices of the investment triangle – Discipline & Time. Discipline is easy when imposed Discipline in investing is an essential ingredient to successful investing. When we stay invested in a right asset over a longer duration, it certainly pays off. Let us take Suresh, a teacher, who has a home loan EMI to pay for 15 years. Only if he pays his monthly EMIs regularly without fail, he could own the property at the end of the loan tenure. Paying a monthly EMI is a huge commitment and requires discipline on part of the investor. Similarly, take Sara, a lawyer, who pays the premium for her parent’s health insurance policy. Only if she pays the annual premium in a disciplined manner, her parents would be able to avail the hospitalization benefits. Most of us diligently pay our periodic payments in a disciplined way, like Suresh ...