Linking of PAN-Aadhar-Bank accounts

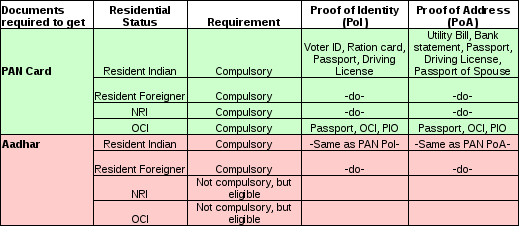

On Jun 9, 2017, the Supreme court in its ruling on IT section 139AA, upheld that all PAN card holders must link their Aadhar with their PAN (Permanent Account Number) for filing of income tax returns from July 1, 2017. And even non-IT assessees who have PAN & Aadhar as of July 1, 2017 must link the two on the IT portal. In another related notification, the government has mandated that all bank accounts in the country need to be linked to Aadhar by Dec 31, 2017, failing which the respective accounts will be frozen. Let us look into the details and impact of these announcements. PAN & its use PAN (Permanent Account Number) is a 10-digit unique ID issued by the income tax department, however a person may have multiple PANs. It is primarily used to file income tax returns and required for most financial transactions such as deposits & withdrawals exceeding Rs.50k, purchase of all assets such as car, bike, home, jewellery, mutual funds, demat accounts, bonds etc. Residents o...