Linking of PAN-Aadhar-Bank accounts

On Jun 9, 2017, the Supreme court in its ruling on IT section 139AA, upheld that all PAN card holders must link their Aadhar with their PAN (Permanent Account Number) for filing of income tax returns from July 1, 2017. And even non-IT assessees who have PAN & Aadhar as of July 1, 2017 must link the two on the IT portal. In another related notification, the government has mandated that all bank accounts in the country need to be linked to Aadhar by Dec 31, 2017, failing which the respective accounts will be frozen. Let us look into the details and impact of these announcements.

PAN & its use

PAN (Permanent Account Number) is a 10-digit unique ID issued by the income tax department, however a person may have multiple PANs. It is primarily used to file income tax returns and required for most financial transactions such as deposits & withdrawals exceeding Rs.50k, purchase of all assets such as car, bike, home, jewellery, mutual funds, demat accounts, bonds etc. Residents of India (Indian or Foreign nationality) as well as non-residents (NRIs & PIO/OCIs) are eligible to apply for a PAN card. PAN is just a photoID with date of birth, there is no other detail on the card.

Aadhar & its use

Aadhar is a unique 12-digit ID issued by UIDAI (Unique Identification Authority of India) after collecting one's address proof, ID proof, mobile number & biometrics (iris scan + all 10-finger prints). It is primarily required if one were to receive any form of payments such as LPG subsidy, MNREGA (rural employment) etc. It is fast becoming essential for all residents of India (Indian or Foreign nationality). While NRIs & OCIs are eligible to apply for Aadhar, it is not mandatory for them (yet).

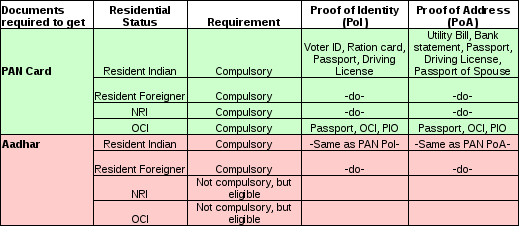

Refer to the below table for a summary of the documents required to obtain PAN & Aadhar.

Linking Bank accounts with Aadhar - who does it affect?

While this is not an issue for most residents, it does affect a small section of the 6 crore NRI/OCI population holding resident savings account (single or joint).

1. NRIs holding resident bank accounts (single or primary holder) - Not allowed

-Redesignate to NRO account before Dec 31, 2017

2. NRIs joint holding resident savings account (but not as a primary a/c holder)

-RBI permits close relative NRIs to be joint holders in resident savings account only on a "former or survivor" basis. Such NRI close relatives are however not eligible to operate the account during the life time of the resident account holder. In this case, aadhar of NRI is not mandatory.

3. NRO & NRE accounts are exempted from linking with Aadhar

In summary, those NRIs & OCIs that own only NRE/NRO accounts are not affected by this aadhar linking mandate. Only those who continue to maintain their resident savings accounts must act in one of the aforementioned ways to avoid freezing of their accounts. Finally, in case an NRI/OCI acquires an aadhar, it must be linked to PAN per 139AA.

PAN & its use

PAN (Permanent Account Number) is a 10-digit unique ID issued by the income tax department, however a person may have multiple PANs. It is primarily used to file income tax returns and required for most financial transactions such as deposits & withdrawals exceeding Rs.50k, purchase of all assets such as car, bike, home, jewellery, mutual funds, demat accounts, bonds etc. Residents of India (Indian or Foreign nationality) as well as non-residents (NRIs & PIO/OCIs) are eligible to apply for a PAN card. PAN is just a photoID with date of birth, there is no other detail on the card.

Aadhar & its use

Aadhar is a unique 12-digit ID issued by UIDAI (Unique Identification Authority of India) after collecting one's address proof, ID proof, mobile number & biometrics (iris scan + all 10-finger prints). It is primarily required if one were to receive any form of payments such as LPG subsidy, MNREGA (rural employment) etc. It is fast becoming essential for all residents of India (Indian or Foreign nationality). While NRIs & OCIs are eligible to apply for Aadhar, it is not mandatory for them (yet).

Refer to the below table for a summary of the documents required to obtain PAN & Aadhar.

Linking Bank accounts with Aadhar - who does it affect?

While this is not an issue for most residents, it does affect a small section of the 6 crore NRI/OCI population holding resident savings account (single or joint).

1. NRIs holding resident bank accounts (single or primary holder) - Not allowed

-Redesignate to NRO account before Dec 31, 2017

2. NRIs joint holding resident savings account (but not as a primary a/c holder)

-RBI permits close relative NRIs to be joint holders in resident savings account only on a "former or survivor" basis. Such NRI close relatives are however not eligible to operate the account during the life time of the resident account holder. In this case, aadhar of NRI is not mandatory.

3. NRO & NRE accounts are exempted from linking with Aadhar

In summary, those NRIs & OCIs that own only NRE/NRO accounts are not affected by this aadhar linking mandate. Only those who continue to maintain their resident savings accounts must act in one of the aforementioned ways to avoid freezing of their accounts. Finally, in case an NRI/OCI acquires an aadhar, it must be linked to PAN per 139AA.

PLEASE READ PLEASE READ PLEASE READ

ReplyDeleteHello everyone, i would like to share my experience on this platform. i have been hearing of Blank Atm for a while and i applied through a few people but i was scammed, not until i found Mr George who saved me from scammers, i got my blank ATM card in 5 days after application and tried the encrypted card in an ATM machine and pos cash store to my greatest surprise i was able to withdraw $3000 and that was the daily rate i applied for. to be honest there is no risk involved the card is not traceable and has an infrared signal that blocks off CCTV during your withdrawals. i just payed my daughters tuition fee and cleared my mortgage debts, i am also richer and started a business that is doing fine. Mr George is really a life saver and he is very genuine. You can contact him with this email address: blankatm402@gmail.com

Best wishes