How to increase Savings when Income is constant? - Part I

So

far we have seen how to measure the combined returns of one’s asset

mix, called the portfolio, understand the difference between nominal

& real returns and took a further step to examine the 3 different

types in which assets are classified. In this issue, we are going to

look at increasing your savings, while keeping income constant, by

plugging the leaks on the expenditure side.

Income

– Savings = Expenditure

Most

of you may be familiar with this arithmetic, “Income –

Expenditure = Savings”. The problem with this math is expenses

being variable, savings too becomes variable. This is not good for

your financial health in the long run. So, it is important to first

select a certain fixed percentage (10% or 30%) of your income as

savings and then spend the balance.

Leak

1 – Insurance policies

Insurance

is required only to compensate you for any loss, other than term &

medical policy, rest are not required for an individual. Insurance is

not an investment, there is no such thing as saving through an

insurance policy. So, in a bid to save tax, do not keep buying

insurance policies that you do not understand. The nature of the

product is very complex, returns/bonuses are unpredictable and it is

one of the most mis-sold instruments in the country. So, save

yourself from creating a recurrent leak.

Leak

2 – Rent (vs) EMI’s interest

Just

as the rent that you pay never comes back to you, the interest part

of your EMI too never comes back. So, when going for a home loan,

ensure that the interest part of your EMI does not significantly

exceed your rent payout.

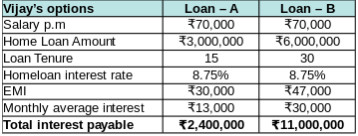

Lets

say Vijay earns Rs.70000 p.m. And he is evaluating 2 loan plans -

Loan-A at Rs.30Lac / 15 years tenure / EMI Rs.30000 p.m. Loan-B at

Rs.60Lac / 30 years tenure / EMI Rs.47000 p.m. Vijay would be

re-paying a total interest of Rs.24Lacs on Loan-A and Rs.1.1Cr on

Loan-B over the respective loan tenures. This means he is paying a

monthly average interest of Rs.13k on Loan-A & Rs.30k on Loan-B,

which he would never get back.

If

Vijay is currently paying a monthly rent of Rs.15000, Loan-A might be

right for him. He could possibly stretch his loan to Rs.40Lacs,

paying an average interest of Rs.18k p.m. In case he stretches it to

Rs.60Lacs in Loan-B, it could lead to the biggest wealth destruction

for him. We shall see about this in detail in a future article.

Leak

3 – Home Loan Pre-payment

Many

of us get bonuses each year during the tenure of our home loan. How

many of us utilize it to pre-pay the loan and how many of us use it

to buy a vehicle/white goods/jewellery?

Lets

say Raj has a home loan for Rs.30Lacs / 15years / EMI Rs.30k. And he

used his bonus of Rs.6Lacs to pre-pay his home loan, in the 4th

year of loan tenure. This translates to a savings of Rs.8Lacs in his

total interest outgo – I.e, it plugs 33% of his leak in interest

outgo.

Although

your bank makes it difficult for you to pre-pay or foreclose the home

loan, go in for a pre-payment - even a smaller amount of say Rs.2Lacs

helps you to save a big leak. The secret here is to make maximum

pre-payments within 1/3rd of your loan tenure – I.e if you have a

15 year loan tenure, try to make smaller pre-payments before the 6th

year to reduce your interest liability by 30-50%. Multiple home loan

pre-payment(s) is your best aid in wealth building.

Leak

4 – Vehicle

Similarly,

when your home loan EMI is active, try avoiding additional big ticket

loans, especially one for a depreciating asset like vehicle. Try to

car-pool or use cab-hailing services such as ola & uber. If you

must buy a car, go for a re-sale vehicle. This way you could

instantly save 30% on your purchase, say you could get a Rs.7L car at

Rs.4.8L and plug in the high interest leakage on your car loan.

Do

these changes really make a difference?

Long

term wealth building is always about making every financial decision

count. If you save Rs.8Lacs interest outgo from your home loan in the

4th

year like Raj and invest it in equity mutual funds, it could be worth

Rs.26 Lacs (at 12% p.a return) by the time your home loan ends.

Instead

if you get caught unknowingly in an ill-structured home loan, you

forego yourself of the opportunity to increase your portfolio value

by Rs.26Lacs. Similarly if you are mis-sold an insurance policy, you

lose the opportunity to double your money immediately. Such is the

power of plugging big leaks – they help to increase your savings

even if your income is constant.

We’re

going to see how to plug 4 more leaks in the next issue!

This comment has been removed by a blog administrator.

ReplyDeletePLEASE READ PLEASE READ PLEASE READ

ReplyDeleteHello everyone, i would like to share my experience on this platform. i have been hearing of Blank Atm for a while and i applied through a few people but i was scammed, not until i found Mr George who saved me from scammers, i got my blank ATM card in 5 days after application and tried the encrypted card in an ATM machine and pos cash store to my greatest surprise i was able to withdraw $3000 and that was the daily rate i applied for. to be honest there is no risk involved the card is not traceable and has an infrared signal that blocks off CCTV during your withdrawals. i just payed my daughters tuition fee and cleared my mortgage debts, i am also richer and started a business that is doing fine. Mr George is really a life saver and he is very genuine. You can contact him with this email address: blankatm402@gmail.com

Best wishes

Your Blog Information To Good Keep It Up.

ReplyDeleteAlgo Trading